Our Views

Morocco Hotel Market Report 2024

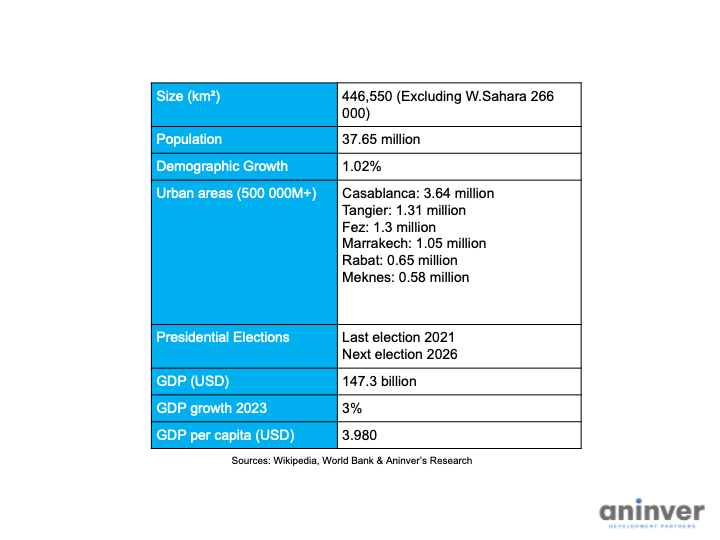

Country General Data

Political & Economic context

As of 2024, Morocco's political environment is characterized by its stable monarchy under King Mohammed VI, continuing its path of gradual political liberalization and economic reforms. The country's economic context is marked by efforts to diversify beyond agriculture and phosphates, emphasizing renewable energy, tourism, and manufacturing. Morocco's strategic location as a bridge between Africa and Europe, coupled with significant investments in infrastructure, including ports, highways, and renewable energy projects, supports its ambition to become a regional economic hub. However, challenges such as unemployment and regional disparities persist.

Moroccan cities account for three of the top six fastest growing North African city economies: Tangier, Casablanca and Marrakech. Tangier is the most notable. The city benefits from its favorable position on the Strait of Gibraltar and proximity to the rapidly expanding Tangier Med port. Manufacturing industries make up the largest sector in Tangier. Likewise, the large industrial sector (notably automotive and aerospace) will be important to the future success of Casablanca. In Marrakech, the consumer services is expected to be an important driver of growth.

Key destinations

Morocco's key hotel destinations include Marrakech, known for its historic medina and luxury resorts; Casablanca, offering a blend of modernity and heritage; Agadir, popular for beach vacations; Fes, celebrated for its ancient cultural heritage; and Tangier, a gateway between Africa and Europe with diverse influences. Each destination offers unique experiences from traditional Moroccan riads to contemporary luxury accommodations, catering to a range of travelers seeking culture, relaxation, and adventure.

Tourism Demand Analysis in Morocco

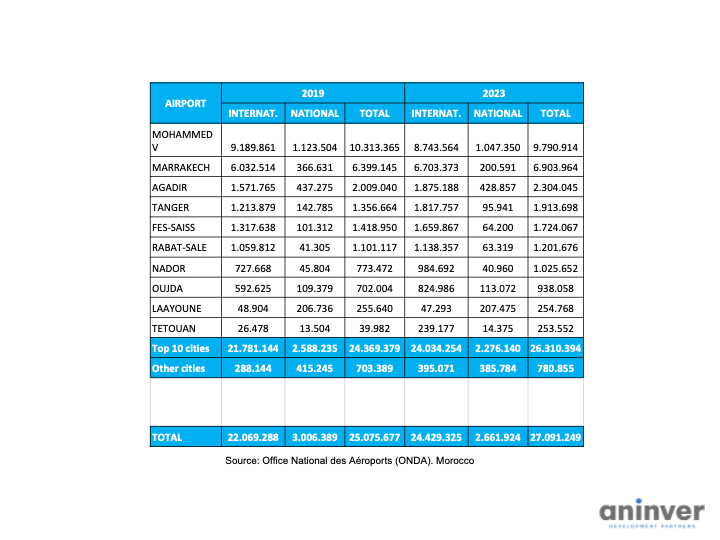

Air traffic in Morocco

In 2023, Moroccan airports collectively handled 27.091 million travelers, with Mohammed V Airport leading at approximately 9.79 million. Marrakech followed with about 6.9 million, and Agadir served over 2.3 million passengers. Notably, Tanger and Fes-Saiss also contributed significantly to the traffic with around 1.9 million and 1.7 million travelers, respectively.

From 2019 to 2023, Moroccan airports witnessed a growth in total visitors, indicating a tourism recovery. The mix between national and international travelers evolved, with a notable increase in international visits, particularly in major airports like Mohammed V, Marrakech, and Agadir. These airports have been central to Morocco's tourism, serving as key entry points for visitors due to their connectivity, facilities, and proximity to major tourist attractions, underscoring Morocco's appeal as a global destination.

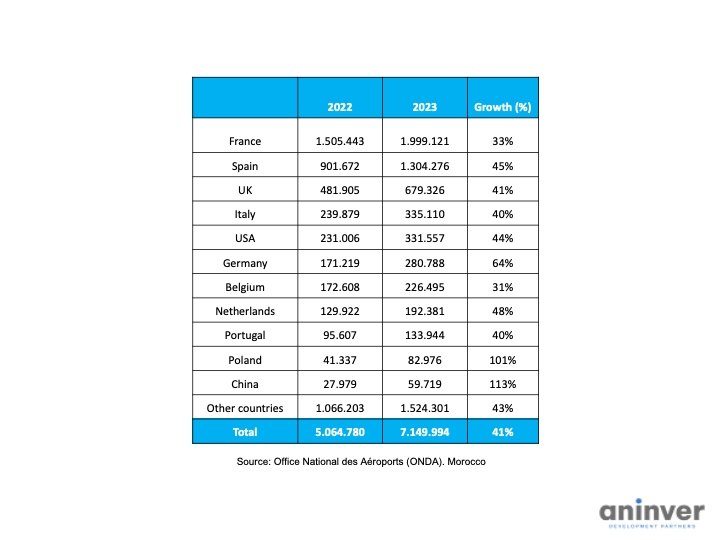

International arrivals by country origin

The tourism sector in Morocco accounts for 7% of the GDP. It employs 5% of the population directly, but it has a huge impact on other sectors, especially handicrafts, which employs 2.5 million people in Morocco. The sector generates US$9 billion in foreign exchange earnings.

There was a significant increase in arrivals to Morocco from various countries between 2022 and 2023, with overall growth of 41%. France, Spain, and the UK were the top three sources, showing substantial increases of 33%, 45%, and 41%, respectively. Notably, arrivals from Poland and China more than doubled, evidencing Morocco's expanding appeal across diverse global markets.

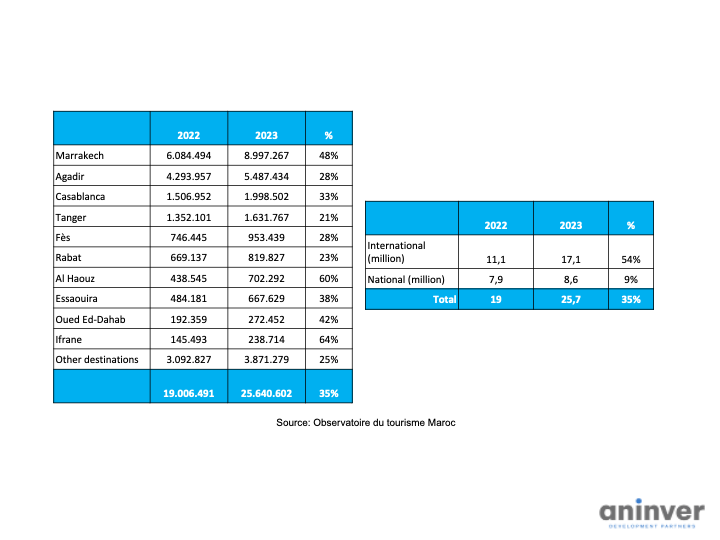

Hospitality Overnights by destination

There was a significant increase in overnight stays across Moroccan destinations from 2022 to 2023, with an overall growth of 35%. Marrakech and Agadir led the surge with 48% and 28% increases, respectively. Other notable growths were seen in Al Haouz (60%) and Ifrane (64%), highlighting their emerging popularity. Casablanca, Tanger, and Fès also experienced substantial growth, contributing to the total rise in overnights to 25.64 million in 2023.

International and national overnights

From 2022 to 2023, international tourism in Morocco surged by 54%, from 11.1 to 17.1 million visitors, while national tourism experienced a modest growth of 9%, increasing from 7.9 to 8.6 million.

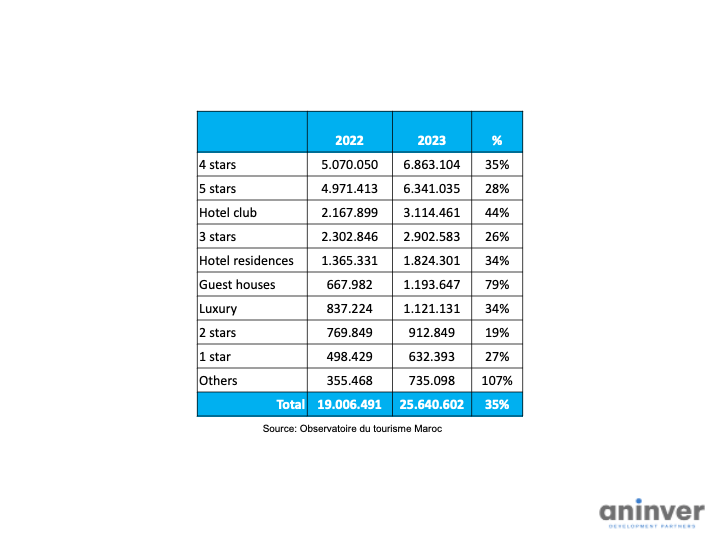

Overnights by hotel category

Morocco saw a significant growth in accommodation types in Morocco from 2022 to 2023. 4-star and 5-star hotels saw growth of 35% and 28% respectively, while hotel clubs experienced a 44% increase. Guest houses had the highest growth rate at 79%. The "Others" category, which could include alternative lodging options, witnessed a remarkable 107% increase. Overall, the total accommodation sector grew by 35%, indicating a strong uptick in tourism and a diversified accommodation offering catering to various preferences and budgets.

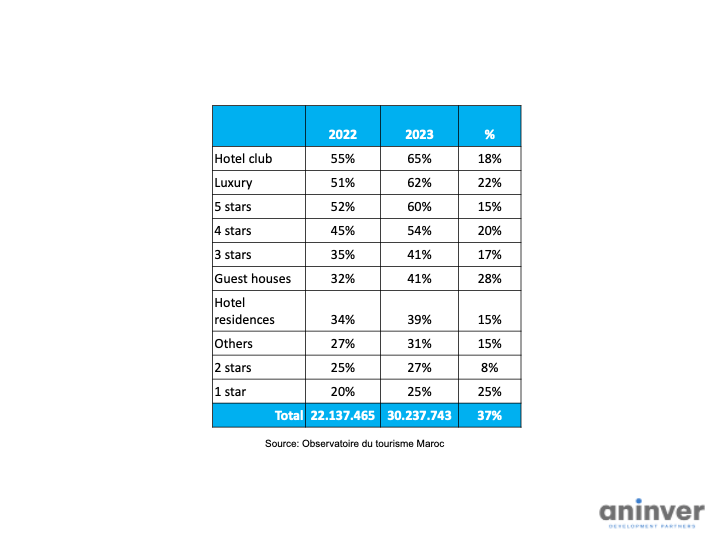

Occupation rates by hotel category

From 2022 to 2023, hotel occupation rates in Morocco showed significant growth across all categories, with an overall increase of 37% in total visitors. The most substantial growth was observed in guest houses at 28%, while luxury accommodations and 4-star hotels also saw notable increases of 22% and 20%, respectively. The increase reflects a rising demand in the Moroccan hospitality sector, suggesting a robust recovery and potential for further development within the industry.

Hospitality Supply in Morocco

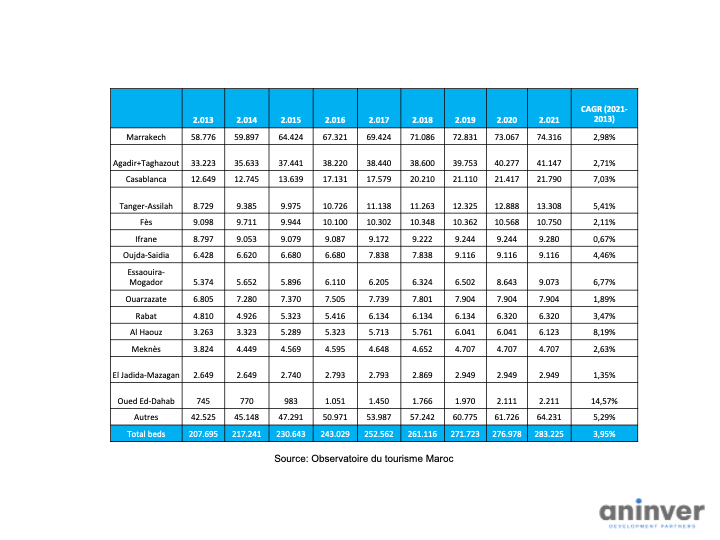

From 2013 to 2021, Morocco's hotel capacity across key destinations like Marrakech, Agadir, and Casablanca showed steady growth. Marrakech's rooms increased by approximately 2.98% annually, while Casablanca experienced the highest growth rate at 7.03%. Emerging destinations like Oued Ed-Dahab and Al Haouz saw significant rises, emphasizing Morocco's expanding tourism appeal. Overall, the country's total hotel capacity grew by 3.95% annually, reflecting continuous investment in the hospitality sector to accommodate an increasing number of visitors.

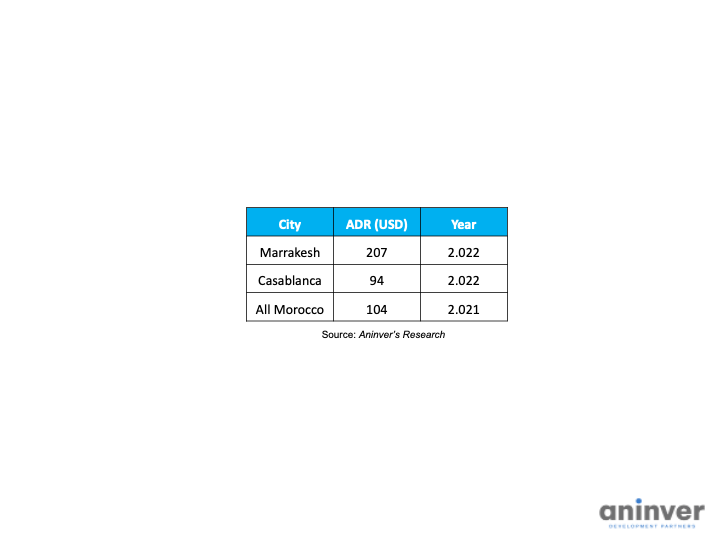

Average Daily Rate (ADR) in Morocco

Although data available is limited, according to sources, Marrakesh boasted the highest Average Daily Rate (ADR) in 2022 for hotels in Morocco at $207. Casablanca is far from that with an ADR of $94. Across all of Morocco, the ADR in 2021 stood at $104, indicating a diverse range of accommodation pricing throughout the country, with Marrakesh positioning itself as a premium destination.

New developments

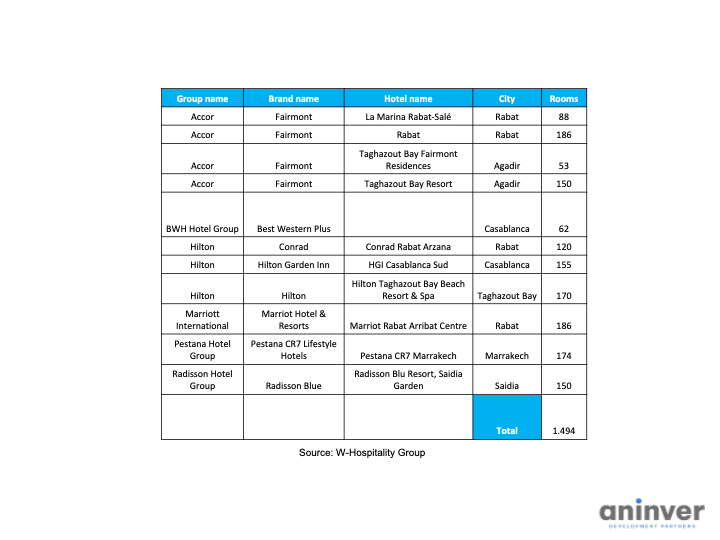

The new hotel developments in Morocco showcase significant investment across various cities, with notable hospitality groups like Accor, BWH Hotel Group, Hilton, Marriott International, and Pestana Hotel Group expanding their portfolios. The developments include luxury brands such as Fairmont in Rabat and Agadir, Conrad in Rabat, and Pestana CR7 in Marrakech, among others, adding a total of 1,494 rooms.

Conclusions

The Morocco Hotel Market Report 2024 illustrates a dynamic balance between supply and demand in the tourism sector. Significant air traffic growth, alongside a robust increase in international and national tourists, underscores a rising demand. Concurrently, substantial hotel development, notably in luxury and traditional segments, meets this demand while fostering competition. A diverse ADR landscape, particularly Marrakesh's premium positioning, reflects the market's depth. These factors combined suggest an attractive investment landscape with ample opportunity for both established players and new entrants in Morocco's tourism industry.