Our Views

How to do Due Diligence of a Construction Company

Aninver Development Partners, as a trusted development consulting company, has great experience executing due diligence of construction firms globally. We have analyzed for our clients companies in different countries.

This article outlines the key components of due diligence in the construction industry based on our experience as consultants.

1. Assessing the Business Status and Prospects of the construction company

1.1 Comprehensive Company Analysis

Initiate the due diligence process with an exhaustive examination of the construction company's present status. Conduct a thorough review of financial documents, operational procedures, and strategic plans to ensure a comprehensive understanding of the business.

1.2 Market Factors and Historical Performance

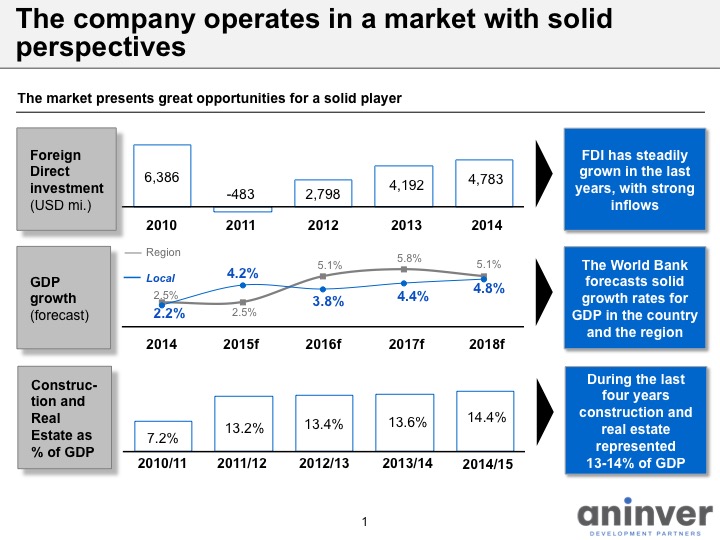

Evaluate how regional factors affecting performance and risk may impact the company's ongoing and future projects. Use the historical performance of the company as a key reference point, providing insights into how the company has navigated challenges and capitalized on opportunities in the past.

1.3 Analysis of the market

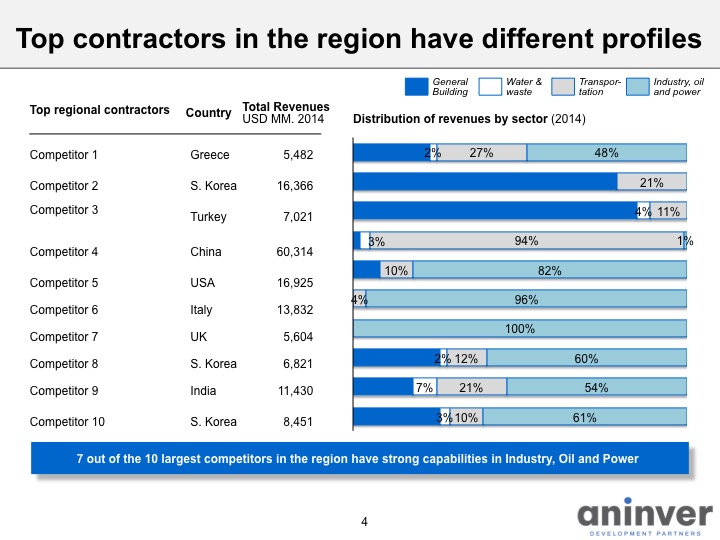

An in-depth market analysis is essential to understanding the construction company's current position within its operating markets. Evaluate market dynamics, competition, and regional factors influencing the construction industry. Assess the company's market share, project pipeline, and relationships with key stakeholders. Consider how the company's current offerings align with market demands and emerging trends. This analysis provides insights into the company's competitiveness and potential growth opportunities within its existing markets.

1.3 Risk Mitigation

Identify potential risks associated with the company's ongoing projects and propose strategies for mitigation. Take a proactive approach to ensure the company is well-prepared to address challenges, safeguarding its reputation and financial stability.

2. Evaluating Business Plans and Financial Performance of the construction firm

2.1 Projected Business Growth

Assess the construction company's business plan for the next 3 to 5 years with a focus on the markets it currently operates in and those it plans to enter. Evaluate the feasibility and alignment of the business plan with the company's historical performance and technical capabilities.

2.2 Backlog and Margin Review

Examine the entire backlog, including project margins, to gain insights into the financial health of ongoing projects. Provide commentary on the achievability of these margins based on a detailed analysis of project complexities, regional influences, and historical performance.

2.3 Historical Performance Analysis

Review historical projects to assess budgeting and forecasting quality. Compare budgeted margins with actual outcomes to identify patterns and trends. This analysis will contribute to understanding the accuracy of the company's financial projections and its ability to meet set targets.

2.4 Revenue Recognition Analysis

Identify how profits and revenues are recorded, particularly if the company uses the percentage of completion method. Conduct a thorough analysis of the methods employed to ensure accurate financial reporting.

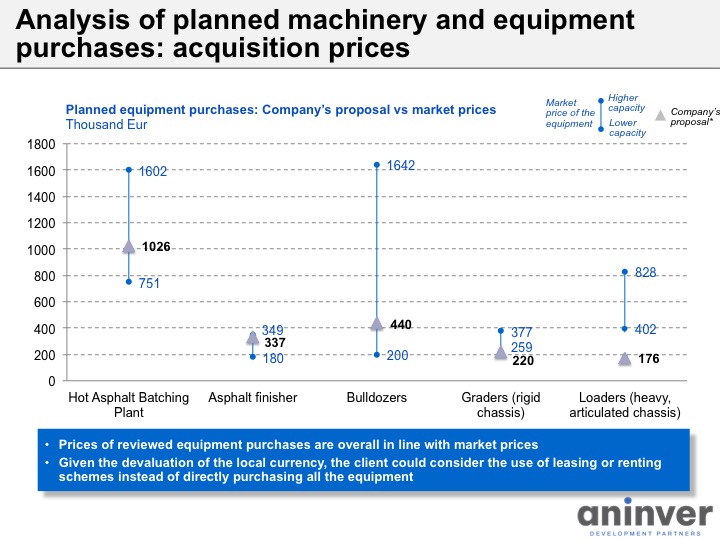

2.5 Equipment Utilization and Remaining Life

Comment on the existing construction equipment owned by the company. Evaluate utilization rates and estimate the remaining life of the equipment. This assessment provides insights into the company's capital assets and their contribution to ongoing and future projects.

2.6 Procurement Approach

Evaluate the company’s approach to procurement. Comment on the Project Management Tools in place for controlling costs and schedules, ensuring efficiency and effectiveness in project execution.

3. Management Team, Organizational Structure, and Workforce of the firm

3.1 Management Team Quality

Evaluate the quality and effectiveness of the management team objectively. Examine the incentives in place for project managers to ensure alignment with company goals. Scrutinize the management systems to verify their efficiency in linking project data into cumulative results.

3.2 Analysis of Workforce

Conduct an in-depth analysis of the workforce, including both manual and non-manual roles. Evaluate the Manual to Non-Manual work force ratio and assess the quality of training provided. This analysis contributes to understanding the competency and skill development within the workforce.

3.3 Organizational Structure Relevance

Evaluate the company’s organizational structure concerning its role as a major contractor/subcontractor/concessionaire. Ensure that the structure is relevant and supports efficient operations in the company’s current and planned markets.

3.4 Workforce Relevance and Risk

Comment on the relevance and risk of the company's workforce. Consider factors such as skillset, adaptability, and workforce stability. Review the Manual to Non-Manual work force ratio and assess the quality of training programs as indicators of workforce preparedness.

3.5 Core Competencies and Key Performance Indicators (KPIs)

Understand the core competencies of the company. Identify and assess key performance indicators (KPIs) and critical success factors. This step is crucial in benchmarking the company's performance against global best practices.

3.6 Benchmarking Technical Capabilities

Benchmark the company's technical capabilities against other comparable construction companies worldwide. This involves a comprehensive analysis of core competencies, technological advancements, and project execution methodologies.

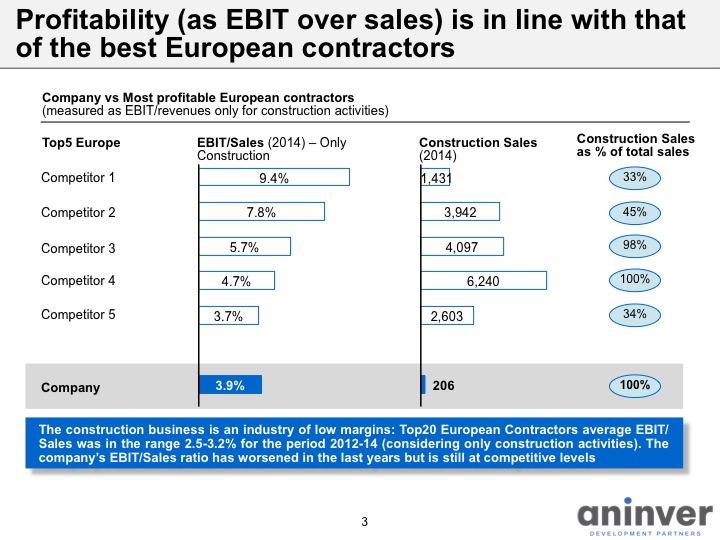

3.7 Benchmarking Financial Metrics

Benchmark the company's financial metrics, including cost base, gross margins, nature and level of contingent liabilities, fixed assets (construction equipment), and outsourcing activity. Provide rationale for any divergences from industry standards.

3.8 Factors Influencing Margins

Identify the main factors that may reduce or increase the company’s margins. This includes a thorough analysis of internal and external influences, market dynamics, and strategic decisions affecting profitability.

3.9 Business Potential Assessment

Based on the factors listed above, provide an informed view on the company’s business potential in its current markets and other markets it plans to penetrate. Consider both strengths and areas of improvement in the evaluation.

4. Legal Review of Main Current Contracts

4.1 Contractual Compliance

Conduct a comprehensive legal review of the construction company's main current contracts. Ensure compliance with local and international legal requirements, regulations, and industry standards. Identify any potential legal risks or liabilities associated with the contracts.

4.2 Performance and Payment Bonds

Examine the terms and conditions related to performance and payment bonds in the current contracts. Ensure that these provisions align with industry norms and legal requirements. Assess the financial implications and risks associated with these bonds.

4.3 Letters of Credit

Review the letters of credit included in the main current contracts. Verify their compliance with legal standards and assess their effectiveness in mitigating financial risks. Identify any legal issues or concerns related to the use of letters of credit.

4.4 Scope, Schedule, and Cost

Analyze the legal aspects of the contractual terms related to project scope, schedule, and cost. Ensure clarity and specificity in defining project deliverables, timelines, and financial commitments. Identify any ambiguities or potential legal disputes in these areas.

5.5 Damages, Changes, and Warranties

Evaluate the legal implications of clauses related to damages, changes, and warranties in the current contracts. Ensure that these clauses are in line with industry norms and legal requirements. Assess the potential financial and legal consequences associated with these contractual elements.

4.6 Performance Guarantees

Examine the provisions related to performance guarantees in the main contracts. Verify their legal validity and assess their adequacy in safeguarding the interests of both parties. Identify any legal challenges or risks associated with performance guarantees.

4.7 Project Acceptance and Testing

Review the legal aspects of project acceptance and testing criteria outlined in the contracts. Ensure that these criteria are objective, measurable, and comply with legal standards. Identify any potential legal disputes that may arise during the acceptance and testing phase.

4.8 Legal Risk Mitigation Strategies

Provide recommendations for legal risk mitigation strategies based on the review of current contracts. Propose amendments or enhancements to contractual terms to minimize legal exposure and ensure a robust legal framework for project execution.

5. Summary and conclusions

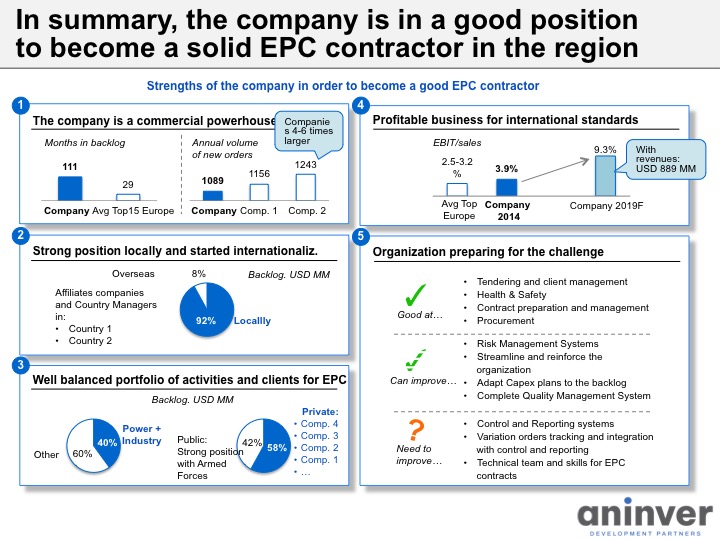

It is very important to detect the main strengths and weaknesses of a company when doing the Due Diligence. It is a good practice to end the report by highlighting the main risks associated with the investment in the company and their likely impact of occurrence.

Check our related Project experience:

- Legal and Technical Evaluation of a construction company in Philippines

- Legal, Technical & Financial Due Diligence of a construction company in Egypt

- Legal and Technical Evaluation of a construction company in Morocco

- Legal and Technical Evaluation of a construction company in Turkey